When raising capital for a business, one of the most crucial decisions entrepreneurs must make is choosing between debt and equity financing. While both methods provide the necessary funding to support growth, operations, or product development, they come with very different cost structures, risks, and long-term implications.

A common belief in the financial world is that debt is generally cheaper than equity, but the actual answer depends on several contextual factors. In this article, we will delve deep into the economics of debt and equity, analyze why debt is usually considered cheaper, and explore the trade-offs associated with each financing method.

Understanding Debt and Equity

Before diving into which is cheaper, it’s important to understand what each financing method entails:

Debt financing involves borrowing money that must be repaid over time, typically with interest. It includes loans, bonds, or lines of credit.

Equity financing means raising capital by selling shares of your company. Investors get ownership and a share in the future profits but are not repaid in the traditional sense.

Each method serves a purpose depending on the stage, financial health, and growth ambitions of the business.

Why Debt Is Typically Cheaper: The Key Reasons

1. Fixed Payments and Limited Upside for Lenders

Debt is usually cheaper because lenders are entitled only to interest payments and the repayment of principal. They do not get a share of the profits or equity appreciation. Their return is limited, and in exchange, they usually demand a lower return on their money.

In contrast, equity investors take on higher risk with the hope of higher returns. If your business becomes highly profitable or goes public, equity holders reap significant rewards. This upside potential makes equity costlier over time.

2. Tax Deductibility of Interest Payments

One of the most substantial advantages of debt is that interest payments are tax-deductible. This reduces a company’s taxable income and overall tax liability, effectively lowering the real cost of borrowing.

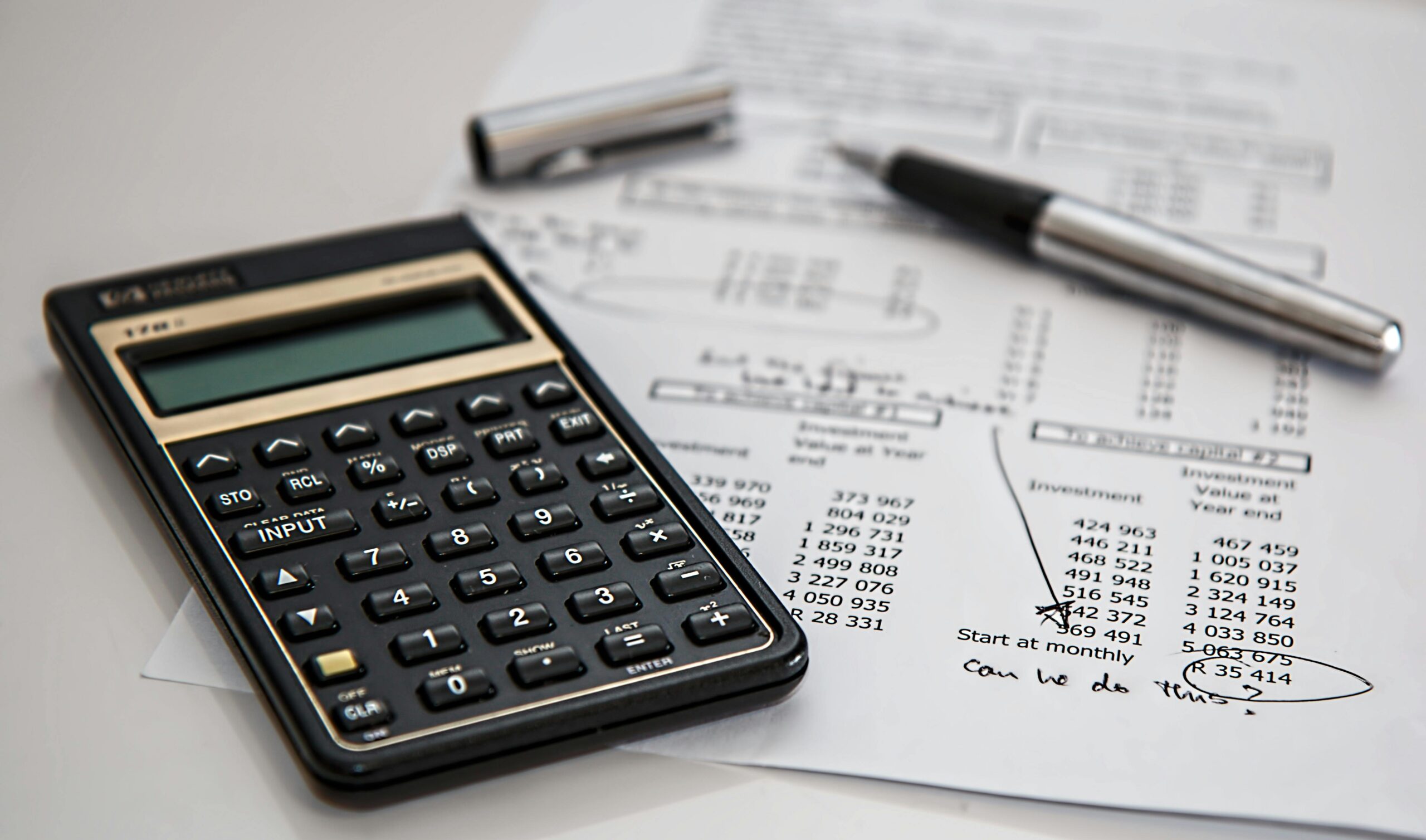

For example, if a company borrows $1 million at 8% interest and is in a 30% tax bracket, the effective cost of debt is:

8% × (1 – 0.30) = 5.6%

This tax shield does not apply to equity, as dividends are not tax-deductible.

3. Lower Expected Returns by Lenders

Debt providers such as banks or bondholders expect lower returns than equity investors. For a stable, revenue-generating company, lenders may ask for 4–8% interest. Equity investors, however, often expect 20–30% or more in returns to compensate for the greater risk.

This difference in expected return makes debt a cheaper form of capital on paper.

The Hidden Costs and Risks of Debt

Despite its lower cost, debt is not always the best or safest option, especially for early-stage startups. Here are the main reasons why debt can be risky:

1. Mandatory Repayments Regardless of Profitability

Debt payments must be made on time and in full, whether or not your business is generating profit. This can strain cash flow, particularly in volatile or early-growth periods.

Missing a debt payment can lead to penalties, default, or even bankruptcy.

2. Reduced Financial Flexibility

With debt on the books, a company might find it harder to obtain additional funding or negotiate terms with new investors. High debt levels also limit a company’s financial flexibility in times of crisis or unexpected expenses.

3. Collateral Requirements and Personal Guarantees

Lenders often demand collateral or personal guarantees for loans, especially for young startups. This exposes the founders or key stakeholders to personal financial risk, which doesn’t happen in equity financing.

Equity: More Expensive but More Flexible

Equity may be more expensive in the long run, but it comes with advantages that are often attractive for startups:

1. No Repayment Obligation

Unlike debt, equity does not require regular payments. Investors take a stake in the company and profit only if the company does well. This means founders can focus on growth without worrying about monthly repayments.

2. Shared Risk

Equity investors share the business risk. If the company fails, they lose their investment but cannot legally demand repayment. This makes equity a safer option for companies with uncertain revenues or high growth volatility.

3. Strategic Value and Expertise

Equity investors, especially venture capitalists and angel investors, often bring expertise, mentorship, and networks. This “smart money” can be a game-changer for startups, providing more than just capital.

The Trade-Off: Ownership vs. Cost

The true cost of equity lies in ownership dilution. When you give away shares in exchange for funding, you’re trading part of your future profits and decision-making power. If your startup becomes a huge success, the equity given away early can be worth tens or hundreds of millions.

For example, suppose you raise $1 million by giving away 20% equity. If your company is later worth $100 million, that 20% becomes $20 million—far more expensive than repaying a $1 million loan with interest.

Comparison Table: Debt vs Equity

| Feature | Debt | Equity |

|---|---|---|

| Cost | ✅ Lower (5–10%) | ❌ Higher (20–30%+) |

| Risk to Company | ✅ Higher (must repay) | ✅ Lower (no repayment) |

| Tax Deductible? | ✅ Yes | ❌ No |

| Dilution of Control | ❌ No | ✅ Yes |

| Investor Involvement | ❌ Minimal | ✅ Often high |

| Flexibility | ❌ Rigid | ✅ More flexible |

| Repayment Required | ✅ Yes | ❌ No |

Real-World Scenarios: When Each Works Best

When to Use Debt:

You have predictable cash flow.

You want to retain ownership.

You can qualify for favorable interest rates.

You’re in a low-risk business with tangible assets.

When to Use Equity:

You’re a startup with little or no revenue.

You can’t afford to make regular repayments.

You want to bring in strategic partners.

You’re in a high-risk, high-reward industry.

Hybrid Approaches: The Best of Both Worlds?

Many companies use a mix of debt and equity to balance cost and risk. Convertible notes and SAFE (Simple Agreement for Future Equity) agreements are popular with early-stage startups, allowing them to raise funds that convert to equity later, often during a priced round.

Another approach is venture debt, where lenders provide loans to VC-backed startups, secured by assets or future equity. This gives startups additional runway without immediate dilution.

Final Verdict: It Depends

So, is debt cheaper than equity? Yes, on paper. The financial cost of borrowing is usually lower due to fixed returns and tax advantages. But this doesn’t mean debt is always better.

The right choice depends on your:

Stage of business

Cash flow predictability

Risk tolerance

Willingness to give up control

For early-stage startups, equity may be more expensive but safer and more supportive. For mature or cash-generating companies, debt can be a smart and low-cost way to fuel growth without sacrificing ownership.

Conclusion: Make an Informed Choice

Choosing between debt and equity is one of the most important strategic decisions any entrepreneur will face. Each comes with its own advantages, costs, and risks. Understanding these trade-offs can help you align financing decisions with your company’s goals and stage of growth.

In the end, it’s not just about which is cheaper—it’s about which is smarter for your business today and tomorrow. A thoughtful capital structure sets the foundation for sustainable success.