Why Most Process Simulations Don’t Match Plant Reality—and How to Close the Gap

Process simulation is one of the most powerful tools in modern chemical engineering. Before steel…

Process simulation is one of the most powerful tools in modern chemical engineering. Before steel is cut, before foundations are…

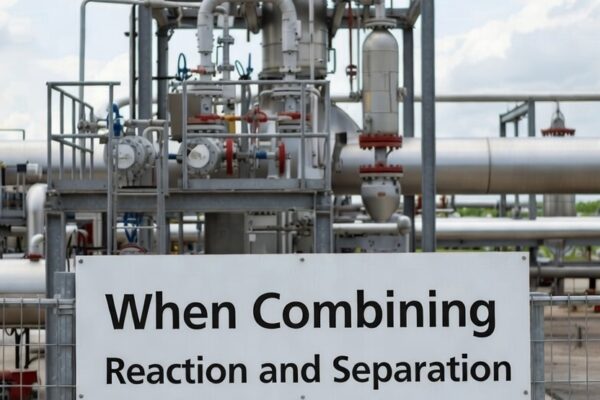

In the world of chemical engineering, few concepts are as intellectually appealing as reactive distillation. The idea seems almost too…

For more than a century, industrial chemical production has been defined by heat, pressure, solvents, and catalysts. Massive reactors, distillation…

Bridging the Gap Between Engineering Theory and Industrial Reality Heat exchangers are the silent workhorses of industry. Found in chemical…

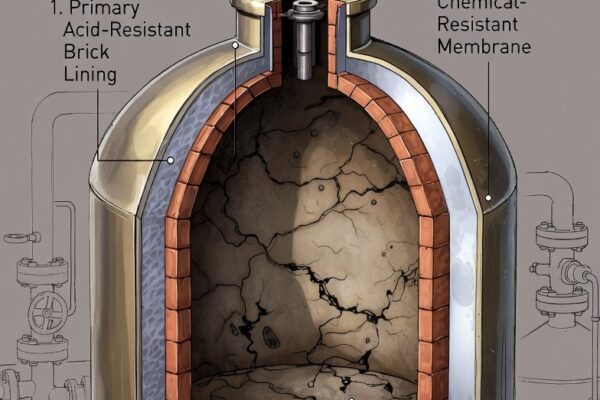

Acid plants are among the most chemically aggressive industrial environments in the world. Facilities producing sulfuric, hydrochloric, nitric, and phosphoric…

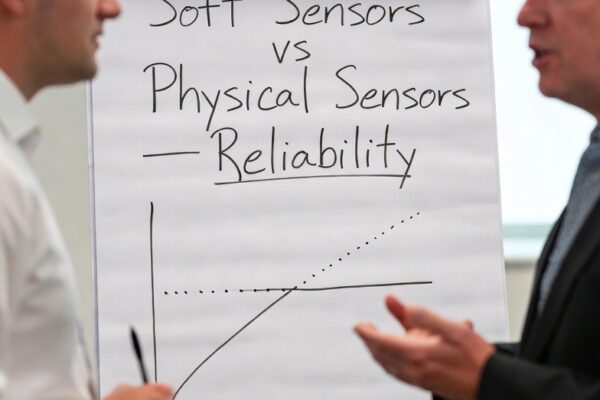

In the era of smart manufacturing, Industry 4.0, and AI-driven optimization, industrial measurement systems are undergoing a profound transformation. For…

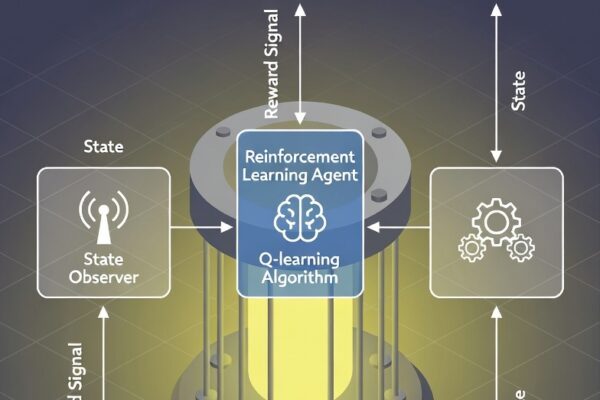

Industrial reactors sit at the heart of modern manufacturing. From petrochemicals and specialty chemicals to pharmaceuticals, polymers, and energy systems,…

Introduction As the global economy settles into 2026, the chemical industry finds itself at a critical juncture. After weathering the…

Introduction The global chemical industry is at a pivotal crossroads. By 2026, regulatory frameworks, sustainability mandates, and international standards are…

Introduction The global energy landscape is undergoing a profound transformation. Rising concerns over climate change, environmental degradation, and fossil fuel…